Message from the CEO

Since its foundation 72 years ago,HORIBA has been working on solving social issues through its core business of “Measurement Technologies”. We are now moving “ONE STEP AHEAD” to new business areas, new regions, and new stages under the Mid-Long Term Management Plan MLMAP2020.

Continuous investment to accelerate growth

HORIBA has been making investment in the hiring and development of talents, R&D, facilities and equipment during economic ups and downs. I am thinking that it is increasingly important to keep investing to respond to significant changes which are witnessed nowadays in the technology trend of various industries. While companies specializing in one industry or one small region find it difficult to make investments during downturns, HORIBA can afford to keep investing from a long-term perspective, as we adhere to balanced management and matrix organization in different regions and business areas with different cycles. This has also enabled us to earn trust from our business partners around the world and to ensure growing prominence of the HORIBA brand globally.

Proactively facing the changing trends in the automotive industry with our “Measurement Technologies”

The automotive industry is anticipated to make significant evolution over the coming years resulting from integration with IT enabling autonomous driving and an energy revolution involving use of fuel cells and other factors. Accordingly, the subjects of immediate and high concern in automotive development will change. Being a car enthusiast I am personally finding the recent evolution of electric cars very exciting.

In 2015 we acquired HORIBA MIRA, Ltd. (U.K.), a provider of engineering services for autonomous driving vehicle development and many different performance tests. I am confident that HORIBA MIRA, Ltd. can become a driving force to change HORIBA’s business model, which has so far had emission measurement systems as a core business, with an 80% global market share. I am pleased that we welcomed HORIBA MIRA, Ltd. in our group just as the automotive industry is going through fundamental changes. Despite short-term concerns over the issue of Brexit, our continual investment in the U.K. and responding to diversification of the needs of customers are indispensable for HORIBA’s mid- to long-term competitiveness. We are committed to accelerating growth in development of next-generation mobility such as autonomous driving vehicles.

Investing to respond to an increase in demand in the semiconductor industry

We have also decided to expand the Aso Factory of HORIBA STEC Co., Ltd., a main production facility of mass flow controllers for semiconductor production equipment. This investment is based on our belief that establishing a stable supply network of products in a long-term growth market can give a sense of reassurance to our customers and enhance the HORIBA brand. Stable supply capacity is critically important for long-lasting relationships with customers.

Although the factory was greatly damaged by the Kumamoto Earthquakes in April 2016, it quickly resumed supply of mass flow controllers, with the cooperation of various stakeholders, including local people, customers, and subcontractors. This episode was also highly regarded by our customers. Continual technology innovation, talents investment, and capital expenditures have enabled us to out-do our competitors, resulting in an increase in our global market share of mass flow controllers from less than 25% in the early 2000’s to 57% in 2016.

We are, however, not satisfied with the current level. We still have big business fields where our market share can rise. In LEDs, photovoltaics, and other new areas with long-term demand growth potential, I am convinced that HORIBA can capture a higher market share as we are always capable of supplying products equipped with cutting-edge technologies.

Accelerating growth in the water measurement area

In MLMAP2020 we are also making significant new investments in business fields and markets with great growth potential, including fuel cells and other alternative energy sources, the bio-life science field, and the water analytical and measurement field. In water measurement we have consolidated our management resources in HORIBA Advanced Techno Co., Ltd. Now we have integrated HORIBA’s first product, the pH meter, and other products, as well as our development, production, and sales resources. Our target is to expand sales from approximately ¥12 billion in 2016 to ¥20 billion by 2020. HORIBA Advanced Techno Co., Ltd., thriving in full swing, reminds me of HORIBA STEC Co., Ltd., which has rapidly grown by being specialized in business for the semiconductor industry. I am looking forward to HORIBA Advanced Techno Co., Ltd.’s future growth.

Adopting a new indicator for realizing the enhancement of capital efficiency

We intend to raise the awareness of our people to the importance of capital efficiency, so as to enable us to continue aggressive investments and make prompt decisions when they are needed. We have decided to adopt a new indicator that incorporates the weighted average cost of capital (WACC) to gauge management of each business segment and each group company. During 2017 we are studying how effectively the indicator can be adopted and utilized as a Key Performance Indicator (KPI) by each Group company. We then plan to introduce it in 2018 and beyond. The adoption of the benchmark is not to restrict investment to realize a high goal; rather, we are hoping to earn appropriate return on investment by each business for our further growth.

Renewing record-high earnings in 2017

In 2016 (ended December 31, 2016), HORIBA recorded consolidated net sales of ¥170.0 billion (down 1% year-onyear) and operating income of ¥18.4 billion (down 8% year-on-year). This was mainly due to a 32% decline from the previous year in the Automotive Test Systems segment, due to the yen’s appreciation and an increase in expenses related to the start-up of the HORIBA BIWAKO E-HARBOR, Biwako Factory. In contrast, the Semiconductor Instruments & Systems segment achieved record-high operating income, thanks to robust capital spending by semiconductor manufacturers and an increase in global share for mass flow controllers for semiconductor production equipment. For 2017, we are targeting to achieve record-high sales, at ¥177.0 billion (up 4% year-on-year), and record-high operating income, at ¥20.0 billion (up 8% year-on-year)*, assuming the exchange rates of ¥110 against the U.S. dollar and ¥120 against the euro. The Automotive Test Systems segment is expected to significantly increase sales and operating income due to strong demand in emission measurement systems on the back of stricter emission gas regulations in many countries, and a recovery in demand in the MCT (Mechatronics) business. The Semiconductor Instruments & Systems segment is also looking forward to an increase in sales and operating income as demand is anticipated to remain at a high level. While the Medical- Diagnostic Instruments & Systems segment is forecasting a decrease in operating income due to forward-looking investments, the Scientific as well as the Process & Environmental Instruments & Systems segments are projecting an increase in operating income.

Finally, our targets for MLMAP2020 are sales of ¥250.0 billion and operating income of ¥30.0 billion in 2020.

* The Company and its domestic consolidated subsidiaries had formerly recognized revenue mainly on a shipping basis. However, starting from the year ended December 31, 2016, the Company and its domestic consolidated subsidiaries have changed to a revenue recognition method using the completion date of installation or a delivery date basis under the terms and conditions of contracts. The forecasts for fiscal 2017, announced on February 14, 2017, the day of announcement of financial results, would not be record-highs when compared to the retrospectively-revised results for fiscal 2015. In the CEO message, comparison is made using the reported results, before retrospectively applying the change in revenue recognition.

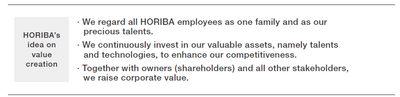

Enhancing our “Invisible Values” to raise corporate value

HORIBA regards employees as important “Invisible Values.” In 2014 we launched the “HORIBA Stained Glass Project.” With the mission of making HORIBA stronger by the continual creation of new value through HORIBARIANs’ diverse talents and skillsets, we are promoting more diversity in our workforce as a basis for management and workstyle innovation.

In 2011 we signed the United Nations Global Compact, a set of universally accepted principles in the areas of human rights, labor, environment, and anti-corruption. We ensure that when we conduct business we are rooted in each country and region, together with local employees, and understand the relevant diverse cultures, customs and values to ensure that we make a positive social contribution wherever we do business.

In keeping with the corporate philosophy of “Open and Fair,” HORIBA has, since its establishment in 1953, always appointed at least one director and one corporate auditor from outside the company. In 2016 we added two outside directors to have three in total for the enhancement of the board (four in the number of independent directors and auditors). Outside directors have diverse experience and unique insights, actively participate in the board meetings and contribute to enhance HORIBA’s corporate value.

HORIBA has regarded shareholders as one of its most important stakeholders and has frequently called them owners. Since our founded, we have also been unique as a Japanese company to allocate profit and pay shareholder dividends based on a payout ratio. Today, our basic policy on returning profits to owners (shareholders) is to target total returns to shareholders at 30% of HORIBA’s consolidated net income (the combination of dividend payments and share buybacks), balancing this with other targets for maintaining financial position standards to enable continuous investment regardless of economic ups and downs, and enable ROE of 10%. In fiscal 2016, we paid a record-high annual dividend per share of ¥85. For fiscal 2017, we are currently forecasting an increase of annual dividend per share to ¥90.

We are committed to contributing to society by providing our “Measurement Technologies” for the benefit of our global customers while working with a sense of challenge and the “Joy and Fun” spirit. I sincerely hope that you will continue to support HORIBA for many years to come, as we are aiming at steadily raising sustainable corporate value.

Atsushi Horiba

Chairman, President & CEO

April 2017